Unggulan

how to add vat to a price

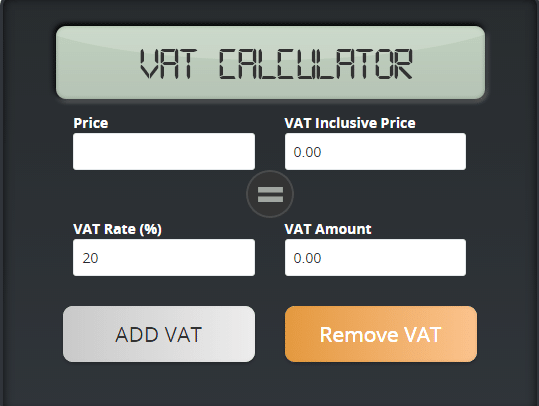

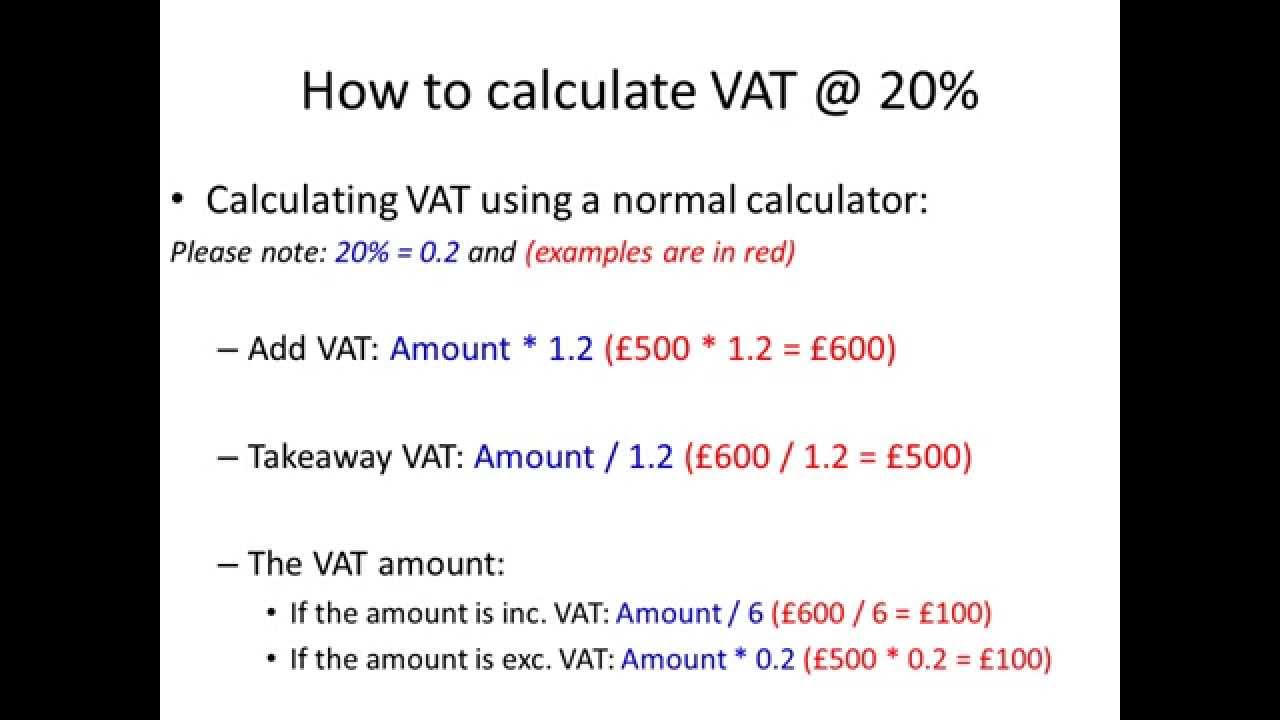

Simply enter the gross sum choose vat calculation operation include or exclude tax percentage and press Calculate or enter button to calculate VAT amount. How to add VAT to a price To calculate the amount of VAT to add to a price we first need to calculate the multiplier.

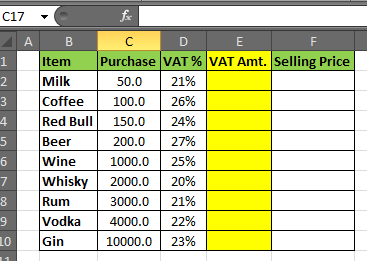

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

If you want to add VAT to a price to divide the amount by 100 and then multiply by 100 VAT percentage.

. VATROUNDB2022540 Total net price including VAT B25403240. Input the price inclusive of VAT. You can work out VAT in two ways by removing reversing VAT or adding including VAT.

This will attract 20 VAT. The formula for how much sales tax you need to add to a gross amount in any currency is. Calculating A Price Including VAT If a price excludes VAT and you want to know what the total cost including VAT would be you need to calculate the VAT amount and then add it to the original amount.

I have been using the following code but I keep getting the same price for price_with_vat as I do for price_without_vat. For example 100 is the price X 12 120 which is now the pricefigure including VAT. Excluding VAT from gross sum.

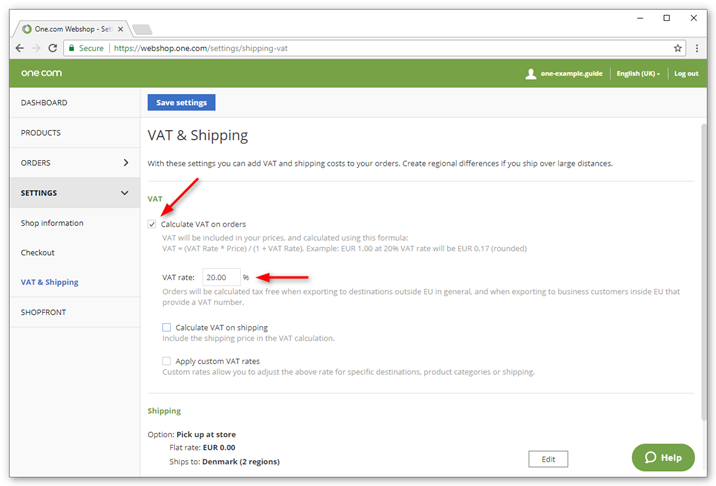

If the applicable VAT rate is 5 youll divide the gross sales price by 105. Check the rate is correct its pre-set to the standard rate of 20 Click the Add VAT button. Explanation of the calculation.

Divide gross sale price by 1 VAT rate For example if the applicable standard VAT rate is 20 youll divide the gross sales price by 12. Adding VAT to values is a very common requirement but doing this in Excel isnt very intuitive and confuses many users. Input the price exclusive of VAT.

To work out a price including the standard rate of VAT 20 multiply the price excluding VAT by 12. To get the multiplier we need to convert the tax rate into a fraction by dividing it by 100 and then add the resulting fraction to 1. Multiply the pricefigure by 1.

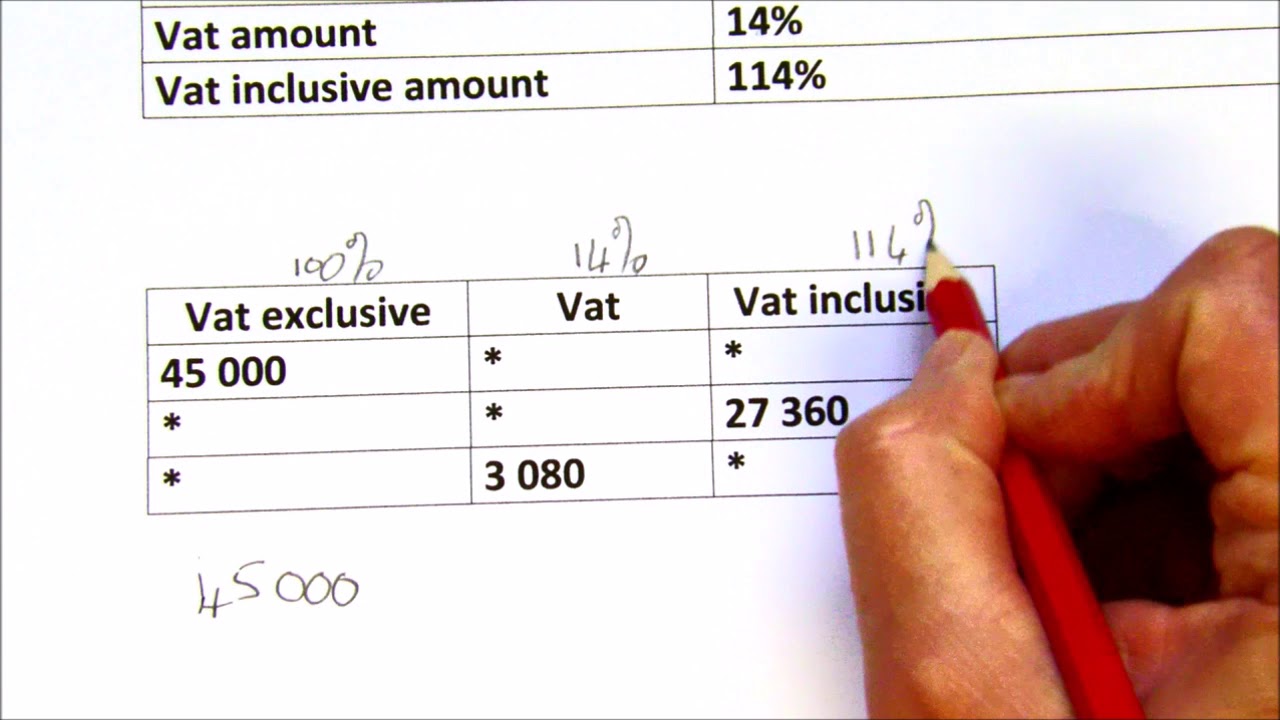

Currently VAT is at 14 therefore. How to add VAT To calculate the current 20 rate of VAT on any number that excludes VAT simply multiply it by 12 and the result will then be inc VAT Formula. Unfortunately this doesnt work.

Exemplify displays the total price with VAT on the store and you have to add the text on your currency switcher app Incl VAT and it then displays that next to all prices. VAT Base Price x VAT So if the gross amount is 20 and the tax rate is 10 the VAT is equal to 20 x 10 2. This will now let you know the price without VAT and the amount of.

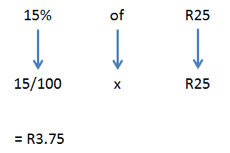

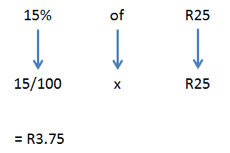

If the tradesman is VAT not registered then they cannot add VAT. 14 divide by 100 014 014 1 114 The multiplier is 114 We can now use this multiplier to calculate VAT that should be added to a price. This is the same as multiplying 20 by 01 which another way to calculate VAT.

However VAT registered businesses must charge VAT on their taxable supplies of goods and services and can reclaim the VAT they have paid that relates to the supplies on which they have charged VAT. By the method of collection VAT can be accounts-based or invoice-based. VAT is a type of sales tax which is levied on consumption on the sale of goods services or properties as well as importation in the Philippines.

VAT stands for Value Added Tax. Formula to add the price and the tax. Total including VAT Original Amount VAT Amount.

To work out a price including the reduced rate of VAT 5 multiply the price excluding VAT by 105. VAT calculation formula for VAT exclusion is the following. A simple Are you VAT registered if so could you confirm that the quote is the price inclusive of VAT e-mail should suffice.

To work out a price including the standard rate of VAT 20 multiply the price excluding VAT by 12. For example the UK VAT rate is 20 which means you would do pricefigure X 12 3. VAT Percentage 2.

Say you buy a desk for your business at a total price of 120. Thats all you got inclusive of VAT value Gross amount. The standard way to implement a value-added tax involves assuming a business owes some fraction on the price of the product minus all taxes previously paid on the good.

If you want to add VAT to the price you just need to divide the price by 100 and then multiply by 100 VAT rate. To add VAT formula. Adding Including VAT Formula 1.

Lets look at a real-life situation. X12Inc VAT How to subtractreverse VAT To subtractreverse the current 20 rate of VAT from any number that includes VAT divide it by 12. Hi Everyone I have been trying to work out how to add 20 vat to a total in php but for some reason I am unable to.

By default the online VAT calculator rate is set for UK VAT calculation. You can also calculate the value of your product with tax in a single formula. How to calculate VAT.

So if we assume that VAT is at a rate of 15 we will need to divide 15 by 100 giving 015 then add 1. So basically you enter all your prices without VAT into agility and set up tax rates in shopify itself. Do I add VAT to my invoice.

The best option would be to clarify with the trademan. Price including VAT Price Tax To calculate the price including VAT you just have to add the product price the VAT amount. VAT is normally added to the price of the goods or services on your invoice.

Thats all you got the price including VAT - Gross price. Check the VAT rate is right for your transaction again its pre-set at 20 Click the Remove VAT button. Your first instinct to add 20 VAT to a number might be to use a formula like this.

The resulting number will now exclude VAT. If you know the price including VAT you can also. Thus the multiplier is 015 1 115 Click here to see how to deduct a from a price.

To simplify it means that a certain tax rate 0 to 12 is added up to the selling price of a. Thats all you got inclusive of VAT value Gross amount.

Exclusive And Inclusive Vat Youtube

Vat Calculator Uae 2022 Add Or Remove 5 Vat

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate And Master Vat Iris Kashflow

How To Calculate Vat 20 Uk From The Vat Calculator Youtube

Wealthy Maths How To Calculate Vat Just One Lap

Postingan Populer

Motor Drawing In Autocad / Autocad Drawing Wooden Boat With An Outboard Motor Side View Dwg Dxf : Download this free 3d cad block / model of an electric motor.

- Dapatkan link

- Aplikasi Lainnya

Wicked Town Tattoo Shop : Wicked City Tattoo Home Facebook / Dave and mikey are really good guys and great tattoo artists and their prices are also very reasonable.

- Dapatkan link

- Aplikasi Lainnya

Komentar

Posting Komentar